Giving your WordPress website visitors a seamless payment experience is possible only with the best WooCommerce payment gateways. Online purchases are the norm today and making your website capable of accepting payments is a necessity for every business.

When trying to integrate WordPress payment gateways with your website you may face challenges like high fees, intricate integration steps, and security concerns.

This makes selecting the right WooCommerce gateway for your website all the more important.

In this article, we discuss the 5 best WooCommerce payment gateways you can choose from.

Read on to find out the most efficient, reliable, and user-friendly payment gateways for your Website.

What is a WooCommerce Payment Gateway?

AWooCommerce Payment Gateway is a plugin or an integrated feature for WooCommerce-powered online stores that enables you to process payments from customers.

WooCommerce is a popular eCommerce platform that runs on WordPress which allows you to build and manage online stores. Payment gateways act as the intermediary between the store and the payment processor or bank, facilitating secure transactions.

WooCommerce Payment Gateways are designed to be secure, with encryption and security protocols to protect sensitive information.

They usually support multiple payment methods, such as WooCommerce credit card processing, debit cards, bank transfers, and more, which offers customers flexibility. They are also meant to be user-friendly, with a straightforward set-up process.

Need help building your WooCommerce website? Here are the 7 Best WooCommerce Website Builders!

How Do Payment Gateways Work?

When customers purchase from your online store, they input their payment details, which are then encrypted and sent to the payment gateway.

This gateway serves as a messenger and queries the customer’s bank to approve the transaction. If the bank approves, the transaction proceeds and you can finalize the sale.

The gateway informs you that the payment has been successful and enables you to confirm the order with your customer.

This efficient process ensures that transactions in your online store are smooth and secure, with funds being transferred from the customer’s bank to your account effortlessly.

Looking for an appealing theme for your WooCommerce store? Here are 5 best WooCommerce Elementor themes.

Best WooCommerce Payment Gateways Compared

| Sr. No. | Payment Gateway | Charges (fees) |

|---|---|---|

| 1 | Paypal | 3.49% + fixed fee |

| 2 | WooCommerce Payments | 2.9% + $0.30 |

| 3 | Stripe | 2.9% + $0.30 |

| 4 | Square | 2.9% + $0.30 |

| 5 | AliPay | Variable based on country |

Let’s now look at the best WooCommerce payment gateways and compare them based on their key features, availability, pricing, and charges.

1. PayPal

PayPal is one of the best payment gateway for WooCommerce and offers a seamless and secure way for online stores to process payments.

It is renowned for its robust security measures and ease of use, PayPal provides merchants and customers alike with a trusted platform for online transactions.

You can keep records of the customers who have bought from your online store such as name, email address, IP address, and shipping address, also you can directly contact the customer via call or email if you feel that the order is suspicious.

Also, there is 24/7 monitoring of transactions to make sure that your transactions are coming from real sources also it gives peace of mind to your customers too.

Key Features of PayPal Payment Gateway

- One-Touch Payments: Customers can check out faster with PayPal’s One Touch feature, which keeps them logged in and lets them purchase without entering their details again.

- Global Reach: PayPal supports payments in over 200 markets and 25 currencies. It is an ideal choice for WooCommerce stores targeting an international customer base.

- Fraud Protection: Advanced security and fraud protection measures are in place to safeguard transactions.

- Flexible Payment Options: PayPal offers various payment methods, including PayPal balance, credit card, debit card, and PayPal Credit.

Availability

PayPal is widely available across the globe and supports merchants and customers in more than 200 countries and regions.

Payment Methods

Customers can pay using their PayPal balance, credit card, debit card, and even PayPal Credit for those who qualify.

It also supports wallets like Venmo and bank redirects. It is one of the best payment gateways for WooCommerce due to its flexibility.

Charges (Fees)

PayPal’s transaction fees vary by country but generally involve a fixed fee plus a percentage of the transaction amount. For sales within the US, the fee is 3.49% + fixed fee.

Pricing of PayPal Payment Gateway

There’s no monthly fee for using PayPal’s basic payment processing services with WooCommerce.

2. WooCommerce Payments

WooCommerce Payments offers a tailored, integrated payment solution that enables you to manage customer transactions directly within your WooCommerce dashboard.

It simplifies the checkout process, allowing customers to pay without leaving your website, thus enhancing user experience and streamlining your sales management.

Also, there are various payment options such as credit cards, debit cards, and WooPay even it supports digital payments such as Gpay, and Apple Pay more the payment options more it is convenient for the customers.

Not only that, it has also the best WooCommerce support you can raise a ticket or talk directly with the team so no more waiting for your queries to be solved.

Key Features of WooCommerce Payments

- Seamless Integration: Directly integrates with your WooCommerce store, offering a cohesive checkout experience.

- Comprehensive Dashboard: Access detailed reports, handle refunds, and view transactions all in one place.

- Subscription Management: SupportsWooCommerce payment methods for recurring billing, which makes it an efficient model

Availability

It is designed to cater to a global audience, WooCommerce Payments is accessible in multiple regions including the United States, United Kingdom, Canada, Australia, and more.

This broadens your reach to global customers.

Payment Methods

This gateway supports a wide array of payment methods to ensure your customers can pay how they prefer, including credit cards, debit cards, and more.

Charges (Fees)

WooCommerce payments fees are transparent and competitive, generally set at 2.9% + $0.30 for domestic card transactions in the United States, with slight variations for international payments and additional payment options.

Pricing of WooCommerce Payments

WooCommerce Payments does not impose monthly service fees. This makes it a cost-effective option for businesses of all sizes to efficiently process payments.

3. Stripe

Stripe is one of thebest online payment processors for WooCommerce and offers a powerful and flexible solution for accepting payments online.

Known for its developer-friendly tools, Stripe provides a seamless payment experience for merchants and customers alike to ensure secure and efficient transactions.

With Stripe’s machine learning-powered optimizations, there is no chance of fraud because it is trained on billions of data points. Along with that, it has 100+ payment options and one-click checkout functionality.

Key Features of Stripe Payment Gateway

- Comprehensive Payment Options: Supports a wide range of payment methods including credit cards, debit cards, and mobile wallets like Apple Pay and Google Pay.

- Global Support: Operates in over 40 countries, allowing you to accept payments from customers worldwide.

- Real-Time Reporting: Offers detailed reports and real-time data for tracking transactions and understanding payment flows.

Availability

Stripe is available in more than 40 countries, making it a versatile choice for WooCommerce stores aiming for a global reach.

Payment Methods

Stripe’s extensive support for various payment methods ensures customers have the flexibility to pay how they prefer, enhancing the checkout experience.

It supports cards, digital wallets, bank debits, and vouchers.

Charges (Fees)

Stripe’s pricing is transparent, typically charging 2.9% + $0.30 per successful card charge for businesses in the United States.

Fees vary for international cards and currency conversions.

Pricing of Stripe Payment Gateway

There are no setup, monthly, or hidden fees to use Stripe. This makes it an attractive option for WooCommerce stores of all sizes looking for the best online payment processors.

4. Square

Square is a standout among payment gateways for WooCommerce, providing a robust platform for both online and in-person sales.

It offers a seamless connection between your WooCommerce store and Square’s payment processing, making it simple to manage your sales, inventory, and customer data across both platforms.

Key Features of Square Payment Gateway

- Omnichannel Selling: Square allows you to sell both online and offline by syncing your inventory and sales data in real time.

- Secure Transactions: Offers advanced security features to protect sensitive payment information and ensure trust in every transaction.

Availability

Square is available in several countries, including the USA, Canada, Australia, UK, and Japan, providing a wide range of businesses the opportunity to use this payment gateway for WooCommerce.

Payment Methods

With Square, customers can pay using credit cards, debit cards, and Square Pay, catering to a broad spectrum of payment preferences.

Square accepts Visa, Mastercard, American Express, Diners Club, and other major cards.

Charges (Fees)

Transaction fees are competitive, with Square charging 2.9% + $0.30 per online transaction.

Pricing of Square Payment Gateway

Square offers a free plan for basic in-person and online transactions. You can get advanced features under the Plus Plan starting at $29/month. They also have customizable premium plans.

5. AliPay

AliPay, a leading payment service from China, is rapidly becoming the best payment gateway for WooCommerce stores looking to cater to Chinese customers or expand globally.

Offering secure, convenient payment solutions, AliPay bridges the gap between businesses and one of the largest consumer markets in the world.

Key Features of AliPay Payment Gateway

- Massive User Base: With access to over 1 billion users it is a game-changer for businesses aiming for the Chinese market.

- Cross-Border Payments: Specializes in handling cross-border transactions, allowing international merchants to sell to Chinese consumers easily.

- Multi-Currency Support: Accepts payments in various currencies to facilitate global transactions without the hassle.

Availability

AliPay is primarily available in China, but its cross-border payment solution is accessible to merchants worldwide who aim to tap into the Chinese market or accept payments from Chinese tourists.

Payment Methods

AliPay supports multiple payment methods, including AliPay Wallet, QR codes, and online banking, and all major card service providers, offering versatility to customers.

Charges ( Fees)

The transaction fees for AliPay can vary depending on the country and specific agreement with AliPay. Generally, cross-border transaction fees might be higher compared to local transactions.

Pricing of AliPay Payment Gateway

There’s typically no monthly fee for using AliPay. They follow a custom pricing plan and you can get a quote based on your business needs.

Want to give your customers the best shopping experience? Here are 4 Best WooCommerce Addons & Plugins for Elementor to enhance your website!

Which Factors to Consider Before Choosing the Best WooCommerce Payment Gateway for WordPress?

Choosing the best WooCommerce payment gateway for your WordPress helps ensure a smooth, secure, and efficient transaction process for your customers.

Here are key factors to consider before making your decision:

- Transaction Fees: Compare the fees associated with each payment gateway. These can include setup fees, monthly fees, and per-transaction fees.

- Payment Methods Supported: Ensure the payment gateway supports a wide range of payment methods preferred by your target audience, such as credit cards, debit cards, PayPal, and mobile payments. The more options you provide, the easier it is for customers to make purchases.

- Security and Compliance: Security is paramount in online transactions. Look for gateways that comply with the Payment Card Industry Data Security Standard (PCI DSS) and offer features like SSL encryption, fraud detection, and secure customer data storage.

- Ease of Integration: The payment gateway should integrate seamlessly with WooCommerce. This ensures a smooth setup process and a consistent user experience.

- Availability in Your Region: Not all payment gateways operate in every country or region. Choose a gateway that works in your location and supports the currencies and payment methods of your target market.

Do you Manage WordPress Websites? Download Our FREE E-Book of 20+ Checklist for WordPress Site Maintenance.

- SAVE MAXIMUM THIS BLACK FRIDAY

Don’t Miss the Mega WordPress

Black Friday Select Deals of 2024.

Wrapping Up

Giving customers the best purchase experience possible is every online store owner’s dream.

For this, you have to select the right WooCommerce payment gateway that works with your website and target market.

When creating your online store, finding a payment gateway to use is not enough. The overall experience of your customers depends on how engaging and attractive your website is.

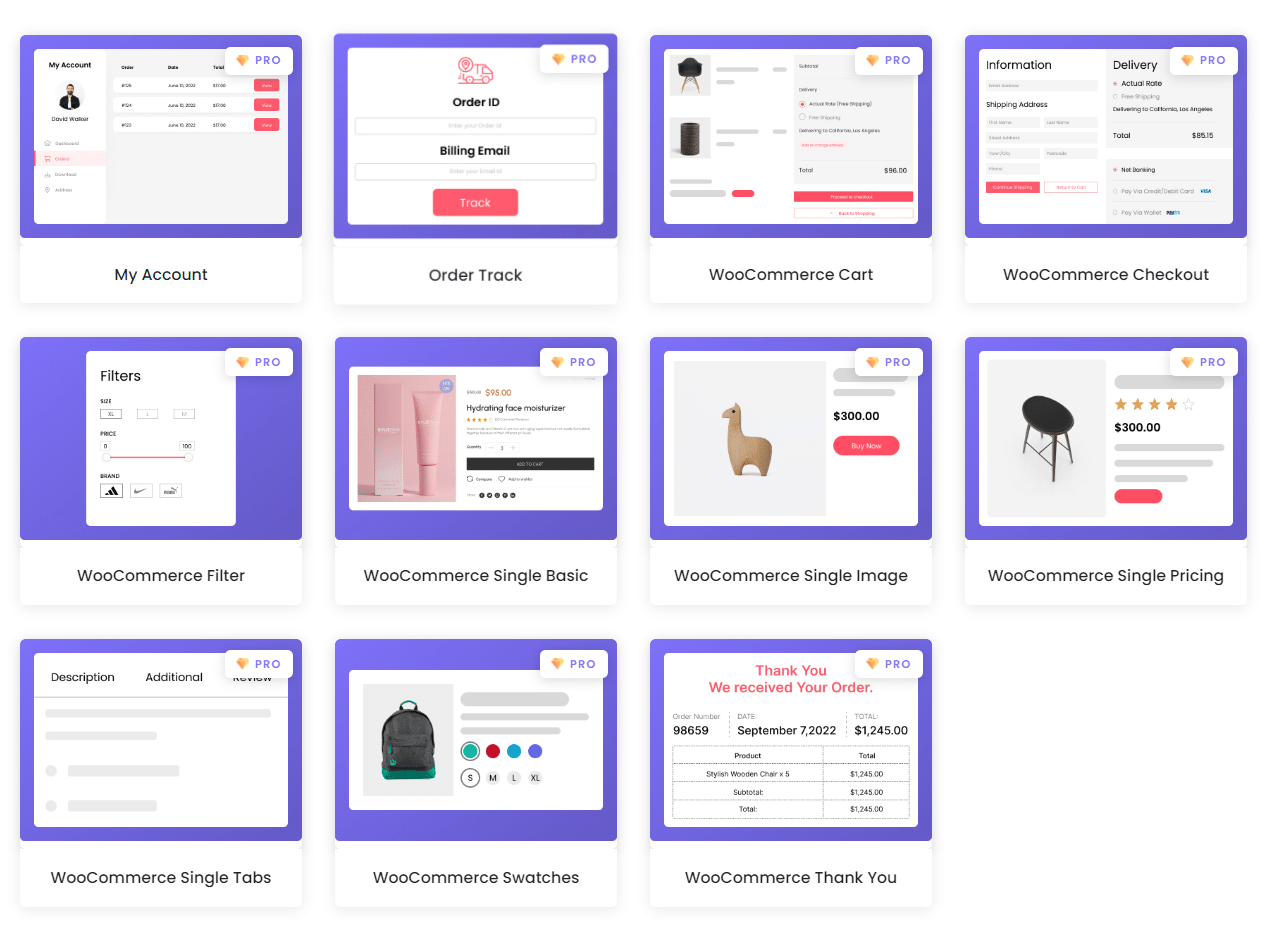

The Plus Addons for Elementor comes in here with the WooCommerce Store Builder, a set of curated widgets to make your online store-building experience smoother.

Additionally, The Plus Addons for Elementor provides you with 120+ unique widgets to enhance the functionality of your WordPress website using the Elementor editor.